Lithium-ion Battery Research Primer.

Summary

The United States is facing a lithium problem, more precisely, it is confronted with an impending supply deficit of lithium, partly due to the lack of infrastructure to harvest and process the raw materials for manufacturing lithium-ion batteries. Lithium is used in various products, from lubricants to cell phone batteries. However, the greatest demand in the coming years will be from a burgeoning industry: large-capacity energy storage used in Electric Vehicles (EVs) and Battery Energy Storage Systems (BESS).

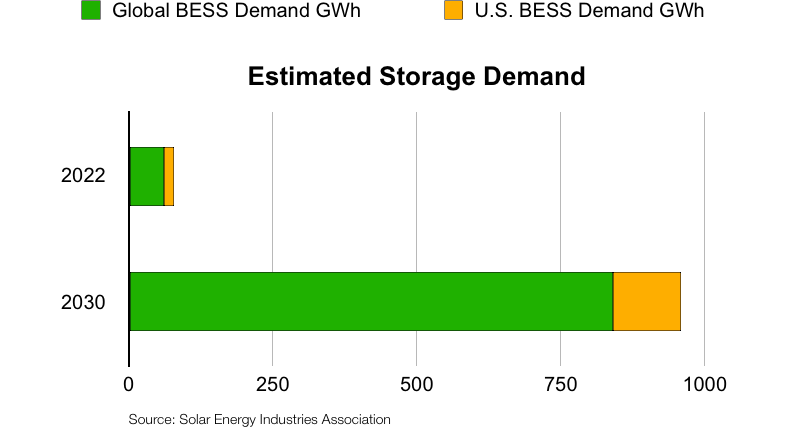

Globally, total demand for batteries in all applications will grow from roughly 670 GWh in 2022 to over 4,000 GWh by 2030. Of that, global demand for battery energy storage systems (BESS), which are primarily used in renewable energy projects, is forecasted to increase from 60 GWh in 2022 to approximately 840 GWh by 2030. And US demand for BESS could increase over six-fold from 18 GWh to 119 GWh during the same time frame.[1]

A prevailing narrative, often fueled by political motives, implies that EV sales have come to a halt. However, the truth is merely a slowdown as EV purchases transition from early adopters to the broader public.The perceived stagnation in EV sales can also be ascribed to inflated estimates of adoption in recent years. These projections stemmed from net-zero objectives set by research firms and governments, enthusiastically backed by original equipment manufacturers (OEMs). As more accurate figures emerged, even from once overly optimistic OEMs, they aligned more closely with actual manufacturing estimates. Nonetheless,the narrative that EVs sales has halted is easily debunked

More than 1.4 million EV’s were sold in 2023, a increase of 2.5pp over 2022, with 377,000 sold in the fourth quarter of 2023.[2]

One of the main hurdles blocking wider EV adoption is the price, exacerbated by the cost of battery systems. However, adoption will accelerate as the cost per kilowatt-hour (kWh) decreases, making EV prices more comparable to those of internal combustion engine vehicles (ICEs).

While there was an oversupply of materials and electric vehicles due to overinflated demand estimates, China has taken advantage of this active destocking to manipulate prices in the industry. By stockpiling inventories of cathodes and other chemicals needed for batteries, Chinese-based companies were and are able to create a supply glut that forced the drop in prices. While artificial, these price drops signaled weakness in the market, deterring investments in the lithium industry, investments that would provide capital to competitors of these Chinese-based companies. However, during this time, the Chinese government subsidized companies like CATL and Xinfeng Lithium, allowing them to invest in foreign projects at a much lower price, expanding their dominance of the lithium-ion market.

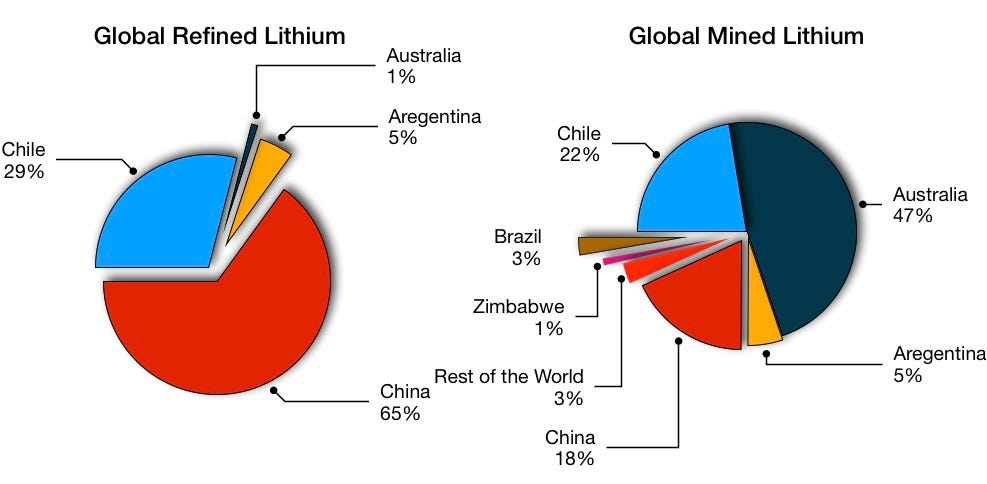

Breaking China's monopoly in the lithium market is seen as crucial for enhancing energy security, supporting economic growth, and promoting sustainable development. By diversifying supply chains and establishing local production capabilities, countries can better meet the growing demand for lithium-ion batteries and accelerate the adoption of clean energy technologies globally. These efforts are essential for creating a more resilient and sustainable lithium supply chain that supports the transition to a material based energy system.

Additionally, countries are focusing on advancing refining technologies to process lithium ore into battery-grade materials domestically. This includes improving extraction processes, refining techniques, and recycling capabilities to enhance efficiency and reduce costs. By developing these capabilities, countries aim to create a competitive advantage in the global lithium market and reduce their dependence on Chinese lithium imports.

The EV industry also needs to overcome the amount of misinformation and overall ignorance surrounding the lithium-ion battery industry. For example, the narrative claiming that only 5% of lithium is recycled stems from a report over a decade old and is itself taken out of context.

From the report of Friends of the Earth, 2016

“The amount of Li-ion batteries collected in the EU in 2010 was estimated at 1,289 tonnes along with 297 tons of lithium primary batteries. This is only about 5% of the Li-ion batteries put on the market, according to the Belgian recyclers, Umicore.”

A figure that was referring to collection has instead over the last decade continues to be contributed to the recycling rate of lithium-ion batteries. Ironically the figure has been used not only by opponents of EVs, but the Department of Energy and lithium-ion battery startups to push their battery recycling programs. It has been estimated that 59% of the batteries available for recycling was recycled.[3] The negative attributed to this narrative is it’s used as a foundation by proponents of the oil and gas industries to delay the adoption of EVs by portraying end of life batteries as a ecological disaster.

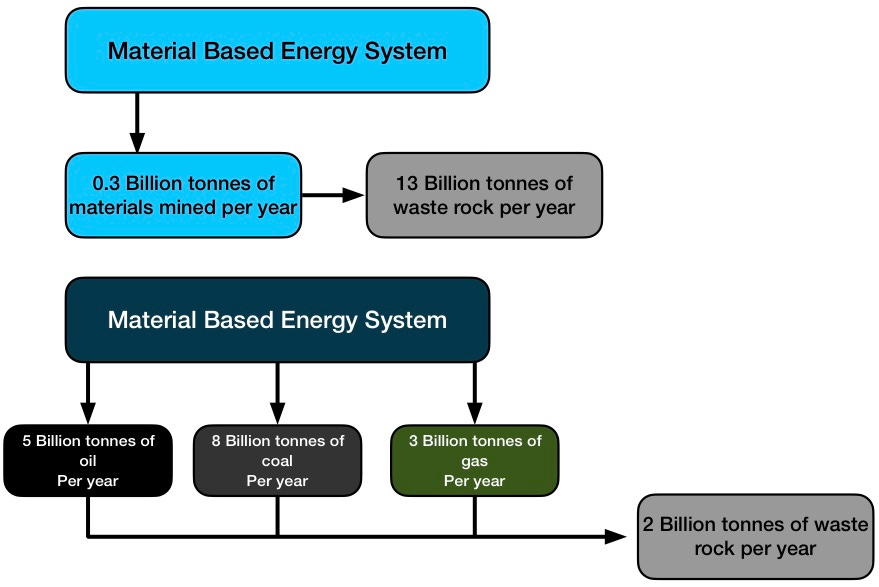

And while there is currently 16 Billion tons of fossil fuels mined and consumed yearly, public perception is vast amounts of land will be destroyed in the mining of materials needed for the energy transition, however additional land use for the energy transition would only be around 0.4–1.1 million km2, comparable to the 0.2–0.4 million km2 used for the fossil fuel energy system.[4]

Also unlike with fossil fuels, where the material is destroyed, the minerals needed for the energy transition are not destroyed and if handled correctly metals like lithium and nickel can be recovered and reused almost indefinitely. Waste rock that is removed to access the ore, is also not destroyed rather moved and stored on site, and with the newer generation of mining projects eventually used as back fill in reclamation processes.

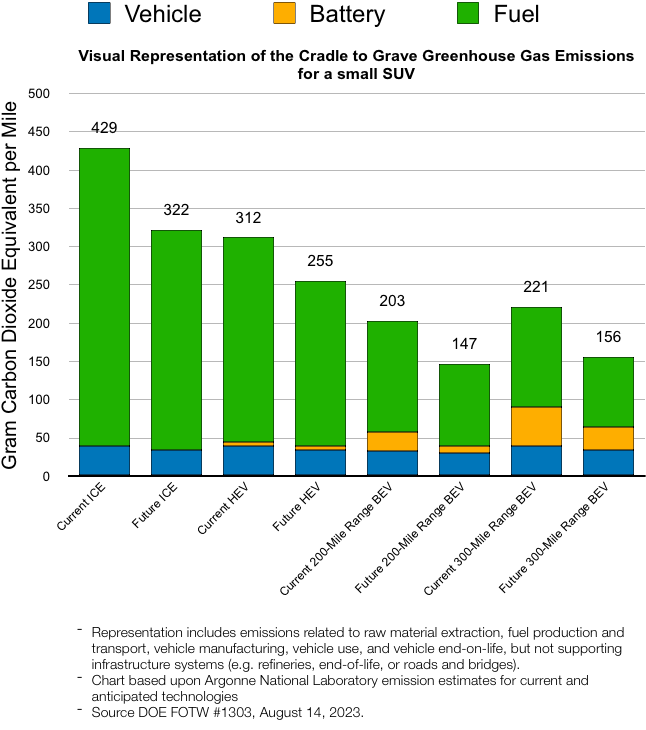

Another of the most prevailing narratives is that EVs pollute more than ICE vehicles because EV manufacturing requires more raw materials.

While it's true that EV production can emit up to 40% more greenhouse gases (GHGs), typically this amount is offset within the first few years of the EV's life. This is partially attributed to the efficiency of the electric motor, which converts around 80% of battery energy into motion, compared to less than 30% conversion of fuel for an ICE. Consequently, there's a significant difference in the vehicles' usage phase, even when the vehicle is charged on a grid where a large portion of electricity is fossil fuel-generated

“An electric vehicle running on electricity generated with coal has the fuel economy equivalent in the order of about 50 to 60 miles per gallon equivalent. So the dirtiest electric vehicle looks something like our best gasoline vehicles that are available today”-David Keith Professor MIT Sloan School of Management who sturdiest the emergence of new technologies in the automotive industry.

However, it's undeniable that the next three to four generations of EVs will require considerable amounts of fossil fuels for production. The extraction, transport, and processing of the materials needed for a lithium-ion battery produce between 100g CO2/kWh to 200g CO2/kWh depending on the location of both the mine and manufacturing facility. But it is estimated that the amount of CO2/kWh can be reduced by 67% with the use of renewables[5]. As lithium-ion battery chemistries evolve alongside advancements in the technology to mine and produce them, each subsequent generation will progressively reduce its reliance on hydrocarbons as a fuel.

In 2022, a total of $21.5 billion from venture capital and private equity was invested in climate tech, with $9.2 billion in the energy sector and $5.3 billion in the transportation sector[6]. While investments need to increase 5x to bring the United States supply and manufacturing infrastructure in line with that of China; however, if conservative models hold, the Lithium-ion battery supply chain is estimated to produce over $62 billion in revenue by 2030[7]. With many lithium projects stating in technical reports that they will have the capability to pay off the original capital investments in 2-4 years after the project has achieved full capacity.

Countries worldwide are intensifying efforts to onshore processing and secure domestic supplies of lithium, aiming to reduce dependency on imports and break China's dominance in the global lithium market. To achieve this goal, countries such as the United States, Canada, Australia, and several European nations are ramping up exploration and mining efforts. They are identifying and developing local lithium reserves, both through traditional hard rock mining and the extraction of lithium from brines and clays. These efforts are supported by government incentives, including tax breaks, grants, and regulatory reforms to facilitate investment and streamline permitting processes.

Quantifying lithium usage or requirements in the lithium-ion battery industry can be complex due to inconsistent reporting practices. In this report, unless otherwise specified, quantities are expressed in lithium carbonate equivalent (LCE). Multiple sources have been consulted to ensure accurate representation of figures concerning production, reserves, resources, processing, supply, and demand, however 100% accuracy can not be guaranteed.

The Lithium-Ion Battery Industry.

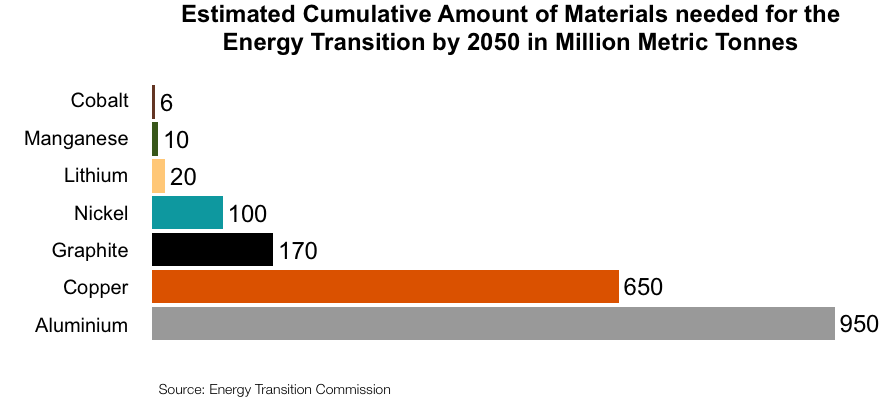

Lithium is but one of the metals essential for transitioning from a fuel-based energy system to a material-based energy system (MBES). The projected cumulative amount necessary for this transition to occur by 2050 is estimated to be considerably lower than the 16 billion tonnes of hydrocarbons mined and burned yearly for energy production. Lithium is extracted commercially from a range of resources including brines and hard rocks. And the extraction processes and technology can also differ significantly for each resource, due to dynamic parameters of geological, time, and economic factors.