American Battery Technology Company (ABAT) FY2026 Q2 Financials

What matters and what doesn’t, and, as always, the parts people never think to look at that mean everything for a startup lithium-ion recycler who is also a junior miner.

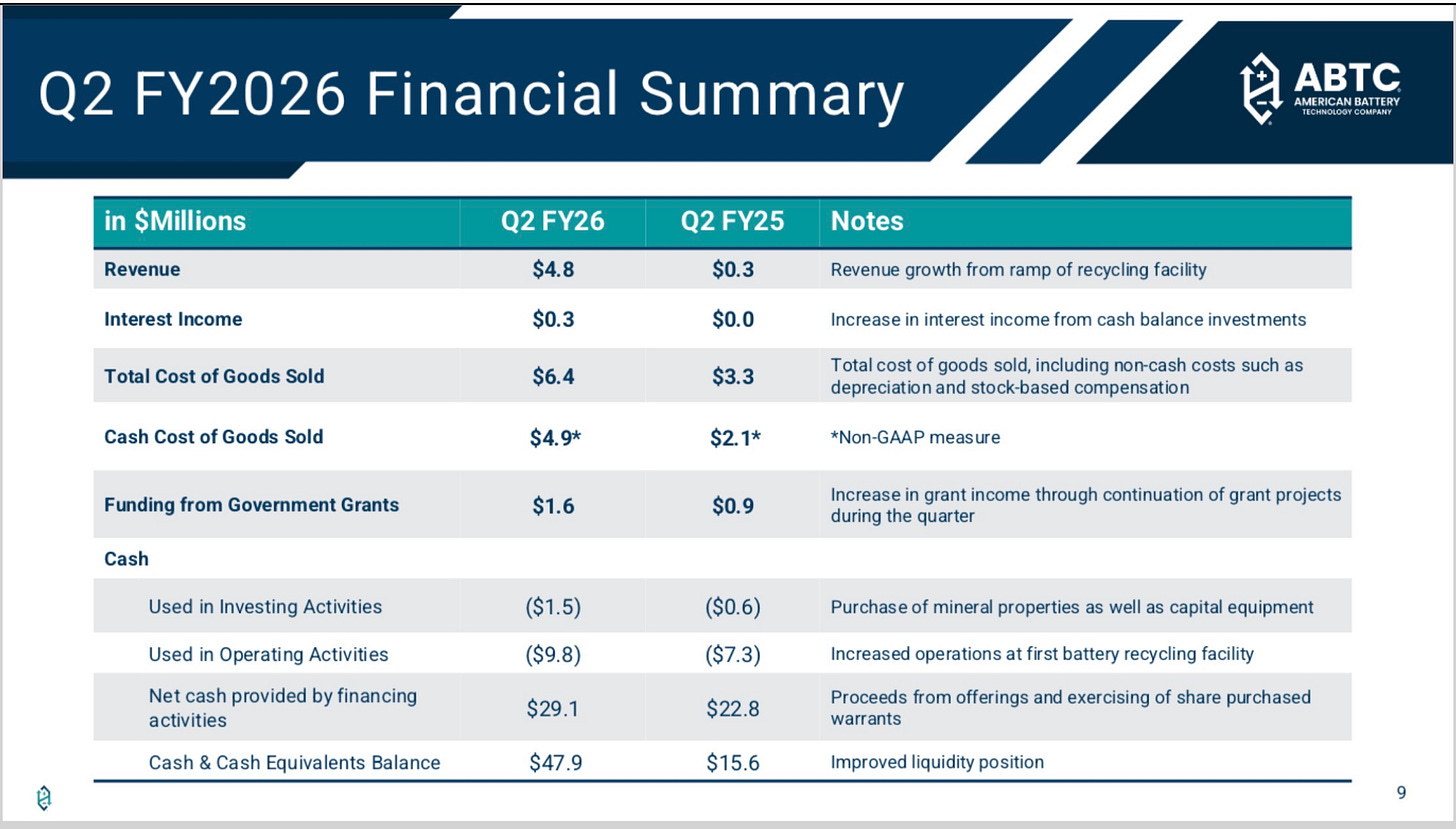

While the major takeaways from the quarterly report for the period ended December 31, 2025, for ABTC NASDAQ: ABAT 0.00%↑ were the increase in revenue with a slight increase in cash COGS, there are a few other items in the report and earnings that need to be looked at, but first the main highlights.

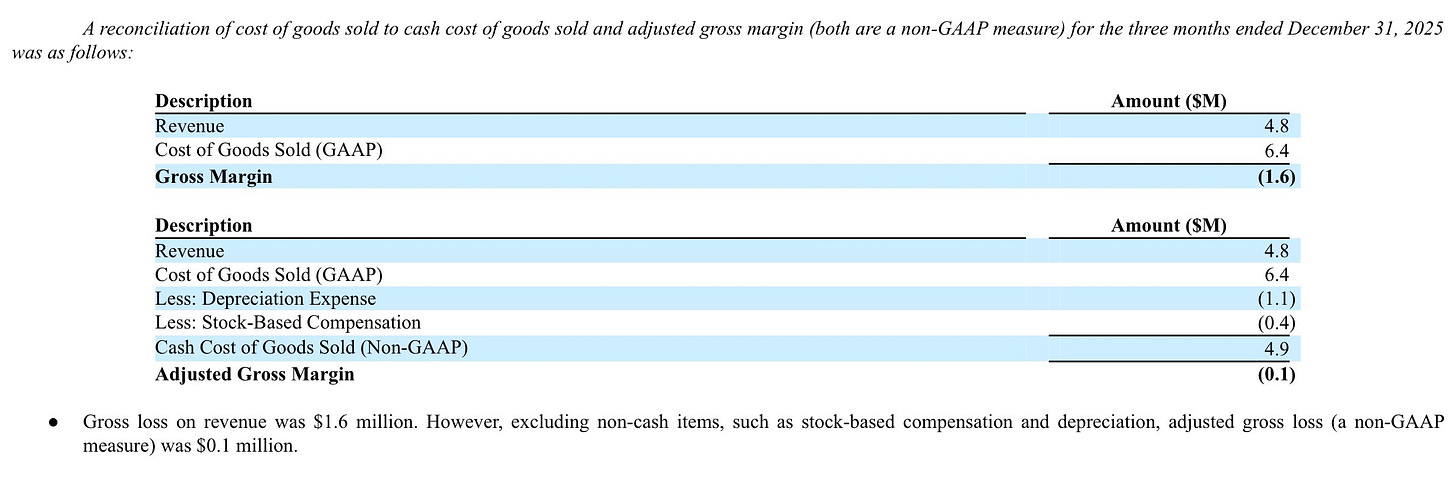

Revenue and COGS

Revenue for the quarter ended September 30, 2025, was $0.9 million, with cash cost of goods sold (cash COGS - non-GAAP) of $3.3 million. For the quarter ended December 31, 2025, revenue increased to $4.8 million, while cash COGS increased to $4.9 million.

Gross loss on revenue for the December quarter was $1.6 million. However, excluding non-cash items such as stock-based compensation and depreciation, adjusted gross loss was 0.1 million. This gives us a margin of roughly -2%, a massive improvement from the previous quarter of -260%, which was a reversal after a consistent improvement from the -500% range to -39% in the quarters before that.

The increase in cash COGS from the September quarter to the December quarter was 48%, while revenue increased 433% over the same period. This means that the rise in cash COGS represented roughly 11% of the revenue growth, showing that ABTC is generating revenue much faster than its direct cash costs are increasing.

Everything else in the financials, such as assets, liabilities, and depreciation, is secondary for a company at this stage, but they do provide a broader picture of how the C-suite is managing and positioning the company for expansion.

Cash on Hand

ABTC’s cash reached $47.9 million as of December 31, 2025, driven by approximately $45.5 million net from ATM offerings and about $10 million from warrant exercises over the six months. These inflows exceeded operating cash burn and increased the balance from $7.5 million at June 30, 2025. Remaining debt was converted to equity, so no cash was used for repayment.

As of December 31, 2025, ABTC reported $0.8 million in restricted cash. These funds are held under letters of credit for two purposes:

Surety bond collateral, which is a guarantee from a third-party insurer to ensure the company meets certain obligations, likely tied to environmental, permitting, or operational requirements from the BLM or a OEM.

A vendor agreement for the supply of feedstock, securing battery scrap or other input materials for the recycling plant.

This cash is not available for general corporate use until the underlying obligations are satisfied or the letters of credit are released. This is down from $5.0 million at June 30, 2025, which was primarily due to a prior loan agreement’s (secured notes) liquidity covenant, now removed since debt is zero.

Cash Burn

Net cash used in operating activities (six months): $16.9 million

Annualized operating cash burn: $34 million

Major non-cash adjustments: depreciation, stock-based compensation

Dilution

Shares outstanding increased to 131.0 million from 97.4 million at June 30, 2025 (34% increase)

Primary sources: ATM offerings, warrant exercises, debt-to-equity conversions

Potentially dilutive shares outstanding as of December 31

Warrants: 12.9 million

Share Rewards Outstanding: 13.6 million

Total: 26,575,320

Currently, there has been no dilution over the past couple of months, but the company has an S-3ASR that is awaiting a notice of effectiveness from the SEC. Once it is effective, dilution may or may not resume.

Net Loss

Q2 net loss: $9.3 million

Six-month net loss: $19.6 million

Bottom Line

ABTC closed Q2 FY2026 with $48 million in cash, no debt, and a stronger liquidity position that could support aggressive growth. Financials will likely remain weak until the net loss situation is resolved, which as a startup could take 3-5 years due to increasing CAPEX needs as the company expands.

Wider Picture

One of the things that was brought up in my chat during the call was Phase 2, now while I do believe we not see a launch of the entire battery grade…

This brings up something else that was noticed, the repetitive use of “critical minerals” in the earnings call. Here is an example:

We receive waste streams back from each of them, as well as end-of-life material to process in our battery recycling plant, where we then manufacture critical mineral products to sell back to our domestic customers to work to close that supply chain.

While some may not realize that cathode active materials such as lithium, nickel, and cobalt in a lithium-ion battery are critical minerals, the company’s planned output goes beyond raw minerals to produce battery-grade products, which are far more important. The company will play two key roles in establishing a domestic supply chain: production and, more importantly, refinement. There is no need to rely on buzzwords or filler phrases when communicating with investors.

Phase 2

When it comes to, and I will continue to use the term Phase 2 for simplicity, there is still no update from the company. I have posted that I believe that Phase 2 will see a staggered roll-out of each of its components, but that is still just a theory. As for any official information on Phase 2, all we really have to go off is what was mentioned in the call.

As we have this cash balance, we’ll be using that to continue to scale operations at this first recycling plant, continue to add additional value-added processes, and also work to move our two new facilities forward.

If we look the increase of equipment value over the last year or so we can see that after 2024 there was not much of a increase:

Jun 30, 2024: $14,313,970

Sep 30, 2024: $22,893,669

Dec 31, 2024: $23,232,967

Mar 31, 2025: $23,660,207

Jun 30, 2025: $24,363,000

Sep 30, 2025: $24,680,273

Dec 31, 2025: $25,784,069

Total change from Jun 30, 2024 to Dec 31, 2025: $11,470,099

So that one little bit in the earnings call, and the fact that after 2024 not much has been spent on equipment, leaves us with next to no meaningful knowledge on the company’s ability to create battery-grade products. The company needs to address this aspect of the recycling vertical soon; if not, the narrative that the company is and will only be a battery shredder will continue.

Debt

I cannot stress enough how relieved I was in the last earnings to find out that they had cleared up and removed all the liabilities with the secured notes. The best way to describe it is that they got the worst payday loan in history and would have paid at least 3-4X the original principal before getting out from under it if they had just let it go and paid the bare minimum.

But now they need to start looking at non diltuitve debt, and obligations based upon long term agreements. They are going to need to take on a lot of debt over the next few years that is why it is great to see them approaching that with a clean slate.

Customers

While the main business model for the recycling vertical is still largely unknown, it can be deduced from the simple fact that they are a recycler and, for the last few earnings, have disclosed the percentage of revenue from “customers”

Customers is a key term here. This indicates they are using some sort of tolling or service model, where they charge a fee to a customer to receive, process, and return the materials the customer wants

Revenue from five major customers during the six months ended December 31, 2025 and two major customers for the six months ended December 31, 2024 accounted for 91% and 74%, respectively, of the revenue for those periods

Since last year, they have added three new customers. For those wondering, these are simple client/vendor setups, not partnerships, and as such do not require an 8K filing. This also alleviates some concern about sourcing feedstock, which is most likely production scrap and end-of-life material from these customers

As they progress from intermediates, the ability to buy end-of-life materials off the open market or from brokers will become more important. One of the main goals of President Trump’s Project Vault is not primarily to stockpile, that is the wording used to convey an idea, but to create a domestic critical minerals market. As the infrastructure for critical minerals is developed in the US, that Warehouse will rely on critical minerals from secondary sources, like the ones ABTC plans to sell, battery-grade sulfates and hydroxides. It will be recycled material like those specialty chemicals that will be the first true products to be bought and sold through the Warehouse.

Moss Landing

This was in the earnings call

Yes, that’s in reference to the Moss Landing project in Northern California, which has been going through decommissioning for many months. We have been receiving material from that facility since the end of the summer. It represents a substantial portion of the feed into our factory, but we do have several other sources from the stationary market as well as the automotive market and the consumer electronics field.

Now in a email shared with me from the EPA we do have an update on the amount of modules that have been shipped from the site.

I don’t have the exact percentages but most of the batteries are sent to ABTC in Nevada. A couple of truckloads have been sent to Cirba when ABC has scheduled maintenance or capacity constraints.

Some stats as of January 30, 2026 below:

19,392 battery modules discharged in preparation for recycling

17,664 battery modules shipped for recycling

Based upon the contract uploaded to EDGAR, we know they are charging a service fee with an option to purchase more “recyclable material” from the site. With the addition of three new customers and the line “capacity constraints” from the EPA mail, this, based upon the earnings this quarter, would suggest that the company is very close to matching its processing capacity with its available feedstock.

I have to say again that the decision some time ago to scale back and build for available feedstock and design for future feedstock could very well have allowed ABTC to avoid the fate of Li-Cycle.

But moving forward, feedstock and battery-grade capabilities will need to parallel each other, not black mass production.

South Carolina

While some posted that the grant for SC was canceled due to USAspending showing the grant as complete, this was, of course, due to a misunderstanding of what performance periods are. The funding period was ongoing; however, the last performance period was complete.

The Company began receiving funds related to this award during the period ending March 31, 2025. As of December 31, 2025, the cumulative funds invoiced for this grant totaled $2.0 million, which represents 1.4% of the total eligible reimbursements. As of December 31, 2025, $0.1 million was an outstanding receivable on the condensed consolidated balance sheet.

From the earnings call.

As far as our recycling operations, we have announced that in addition to our first recycling plant near Reno, we are moving forward with the design and construction of a second battery recycling facility in the Southeast US.

Even in just the past few months, we’ve had several team members at our site in the Southeast US really working with local partners, a lot of our strategic partners in the area as well, and moving the second recycling facility forward.

Now there is a concern about them taking too long, since over the last year no forward progress has been seen, at least publicly. While there were multiple reasons given for the cancellation of the grant to support the construction of a large-scale demonstration plant in Tonopah, all of them were nonsense but one, which more than likely was the real and only reason the grant was terminated: missed milestones.

The concern is that, although the company may eventually achieve its operating goals, its history of missing milestones could put the South Carolina grant in jeopardy.

As for what the Tinfoil Hat and Mayonnaise Society are thinking, the facility will be in the Greenville-Spartanburg area, with the addition of Stellantis alum as the new CFO Alejandro Flores, and that Stellantis and ABTC have been working together as part of the Battery Workforce Challenge, there could be some kind of cooperation with the site between Stellantis, ABTC, and the Argonne National Lab.

For more details, I did a write-up on the South Carolina-based document a long-term investor was able to get from a FOIA request.

FOIA Documents for American Battery Technology Company’s South Carolina Grant.

Tonopah

Since publishing that PFS last fall, we are now working diligently on the definitive feasibility study to be published shortly. This really is the last step to having a bankable design as we engage with each of our investors for the investment in the refinery and mine itself, in addition to finalizing the offtake agreements for the product out of this facility.

Right now, the only real progress that can be seen in the earnings is this:

During the three and six months ended December 31, 2025, the Company capitalized approximately $0.5 million of mine development and related costs associated with activities that improved access to proven and probable reserves.

What does this mean? Think of it like buying a house and remodeling the kitchen. The money spent on the remodel adds value to the house. Similarly, since part of the deposit has been upgraded from a resource measurement to a reserve measurement, the money spent on Tonopah is now considered an investment. Instead of being recorded as an expense that reduces profit, it is listed as an asset on the balance sheet. This accounting treatment is called capitalization.

As for what else we can infer from public statements, the company has submitted all of the technical studies needed for a NEPA review. In ABTC’s case, the lead reviewing agency is the Bureau of Land Management (BLM). The BLM will take all of the submitted information and prepare an Environmental Impact Statement, which evaluates the potential environmental effects of the project and is a key step before permitting and construction can proceed.

Normally, once a Mining Plan of Operation, which the company has posted they are working on, is submitted, the BLM will issue a Notice of Intent and approximately a year later a draft EIS is released. The project is a covered project in the FAST-41 dashboard and per the call the company is talking to the admistration weekly, they still need to get the data to the BLM for the NEPA review to kick off, FAST-41 will only be a factor if the company meets its obligations as the sponsor.

As for the grant per the 10Q

On October 10, 2025, the Company submitted an appeal of the termination and intends to pursue its dispute resolution remedies in connection with the termination of the grant.

That is all we know about the status of that grant…

On the topic of grants there was a section in the 10Q about how the company will be required to report funds received from federal grants:

ASU 2025-10: Companies will have to report government grants more clearly, showing what they received, how it was measured, and any conditions attached. Effective for annual periods after December 15, 2028.

ASU 2025-11: Companies will need to give more detailed explanations in interim (quarterly) reports, including any events after the last annual report that could affect results. Effective for interim periods after December 15, 2027.

ASU 2025-12: Companies will fix and clarify notes and disclosures to make financial statements easier to understand and more accurate. Effective for annual and interim periods after December 15, 2026.

We may, starting in a year or two, actually see for ourselves what progress the company has made or has not made on a grant.

As for any funding, beyond the letter of intent from EXIM for $900 million, which is meaningless until they announce that their application has been accepted, there is no on the books financing for the project. That will change once the Definitive Feasibility Study(DFS) is published and they will not only use that for the EXIM loan, but also to shop around for long term offtake agreements.

I suspect before that time we will see either a partnership or a joint venture announced for the actual mine itself, they are not going to fund it with dilution and they do not have the corporate infrastructure to actually mine the lithium.

Conclusion

ABTC’s Q2 FY2026 results show revenue growing much faster than cash costs. At one point, the most speculative part of the company was the de-manufacturing component of the recycling vertical. While the claystone was speculative, it was essentially just a modified leaching platform coupled with known electrochemical lithium hydroxide production.

The de-manufacturing process was advertised as a way to reverse the manufacturing process to create a cleaner intermediate that would significantly lower OPEX for the battery-grade component of the platform. When the company was finally able to show revenue from this process, it was like proving you can drive a car on a flat tire, it works, but you can’t go far. With this earnings report, the company has shown that not only does the system work, it can be profitable.

The next big hurdle is to take what should be a simplified solvent extraction platform, coupled with the same electrochemical lithium hydroxide production component from the claystone vertical, and start producing the battery-grade materials the country will need. These materials are critical not only to modernize the nation’s aging power grid but also to meet the AI industry’s energy flexibility requirements.

Looking at the rest of the earnings, ABTC now has a strong cash position with no debt, which gives them room to push growth. Financials will remain rough until net losses are addressed, which as a startup could take a few years due to ongoing CAPEX needs.

On the subject of CAPEX, while the narrative that EVs have been put on the back burner persists, the reality is that Auto OEMs have come to realize what ABTC and others in the industry discovered and, as such, avoided falling into the money pit that over the last few years claimed several of the company’s peers. What was learned was that they couldn’t mimic China and build to scale first, the financial markets and infrastructure in the West were simply not in place, so the goal is to build for current demand while designing for future demand.

American Battery Technology Company has the ability to raise cash, a top-tier team, and the advanced technology to meet that current demand. They now need to continue delivering on promises and break the trend of missing milestones so they can be ready to meet that future demand.

If you found this article valuable, consider becoming a subscriber. The Critical Materials Bulletin is supported by readers, and for $5 a month or $55 a year you can help fund research that produces clear, no nonsense reporting that informs and advances the discussion on critical materials and battery metals.

DISCLAIMER: This article should not be construed as an offering of investment advice, nor should any statements (by the author or by other persons and/or entities that the author has included) in this article be taken as investment advice or recommendations of any investment strategy. The information in this article is for educational purposes only. The author did not receive compensation from any of the companies mentioned to be included in the article.